Contents

- What is Stochastic Oscillator?

- Trade indicator signals

- How to use Stochastic Oscillator in Forex

- Several practical notes

The idea is that on a bull trend the closing price always moves to max of settlement period, on descending − to min. In critical zones price is slowed down, and, finally, – there is a turn.

What is Stochastic Oscillator?

The ratio between the current closing price and the max-min range Stochastic Oscillator shows in percentages - from 0 to 100. The value of the indicator at 50% means that the closing price is strictly in the middle of the price range.

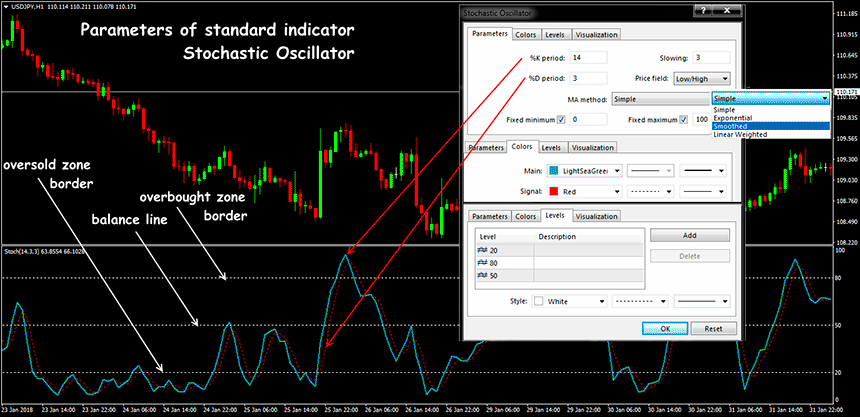

On the price chart Stochastic is displayed in a separate window with a scale of values from 0 to 100 and represents two moving averages and two base levels: 100-80(70) − for the overbought zone and 0-20(30) − oversold.

The calculation of Stochastic Oscillators has not changed much since its creation by George Lane. In the basic version, indicator consists of two lines − a "fast" stochastic %K (by default − a solid line) and a "slow" %D(dashed line).

We calculate the stochastic fast by formula:

%K(t) = ((C(t) − L(n))/(H(n) −L(n)))*100%,

where:

C(t) − PriceClose of the current period;

L(n) – PriceMin for the past N-periods;

H(n) is the maximum price for past n periods.

Line% D is a moving average of %K:

%D = MovingAverage(t)(%K).

The moving average of %D can be of any type, but it is considered that the most stable results are shown by SMA, for high-volatility assets − EMA.

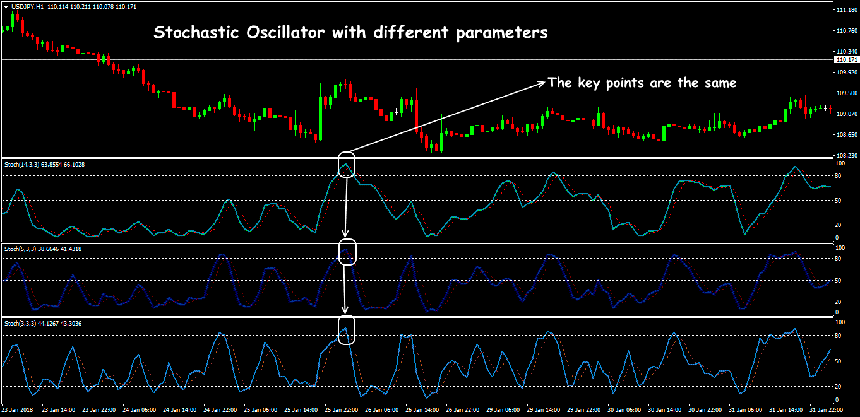

The default settings (14/3/3) work quite efficiently on the main assets, although it is believed that the optimal parameters depend on the timeframe. The larger the timeframe, the shorter calculation period of main line. Thus, on the hour candles parameters (5/3/3), the daytime ones (3/3/3) work well.

Trade indicator signals

Before, how to use Stochastic Oscillator, we recall: its trading logic is similar to standard impulse indicators.

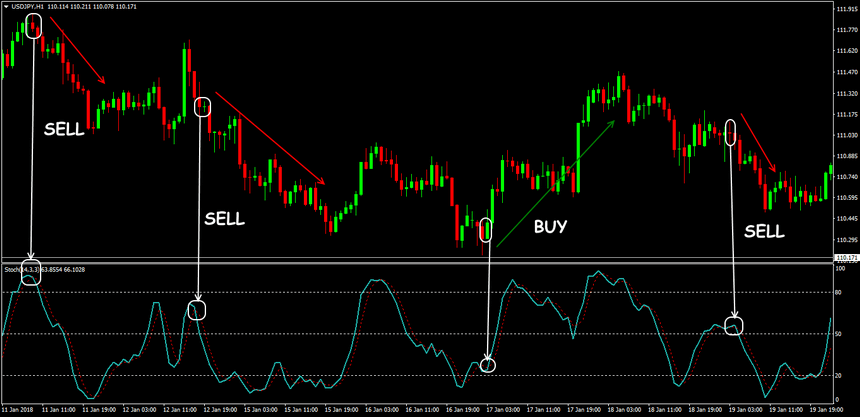

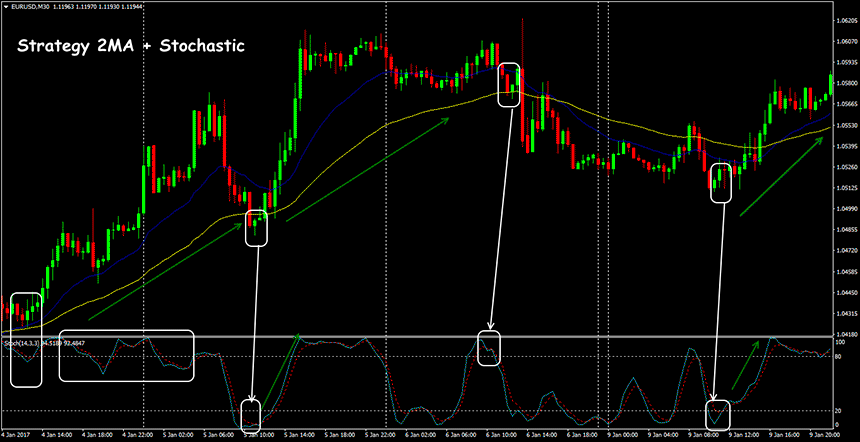

Crossing fast and slow indicator line

- Line %K crosses the rising line %D from top to bottom − purchase (BUY);

- breakdown of line %K of the down line %D from bottom up − sale (SELL).

Breakdown of borders of critical zones

Crossing the main line of level 80 (70) on a bull trend is interpreted as a signal about a probable stop of growth and a possible beginning of price reduction; crossing level 20 (30) in a downtrend - signal about the likely stop of the fall or the beginning of a price increase.

- If line %K is turning from the bottom up and out of oversold zone − open the buy position (BUY).

- If line %K is deployed from the top down and exits overbought zone − SELL transaction.

If the indicator lines only enter the critical zone (below 20 or above 80), then it is better to abstain from transactions; only exit from the zone after turn is considered a trading signal.

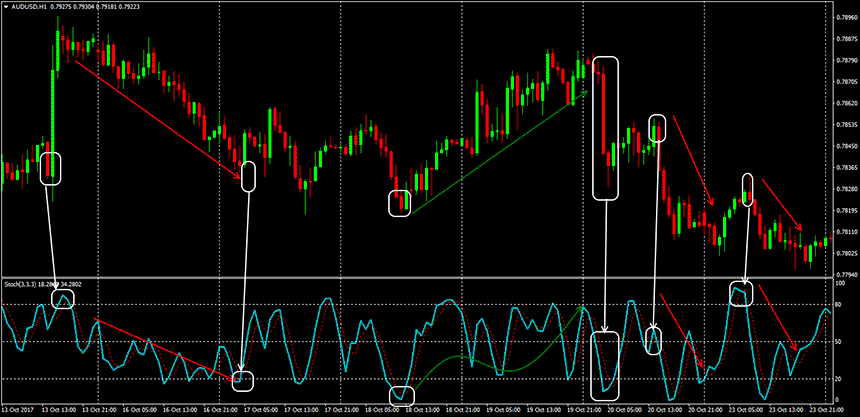

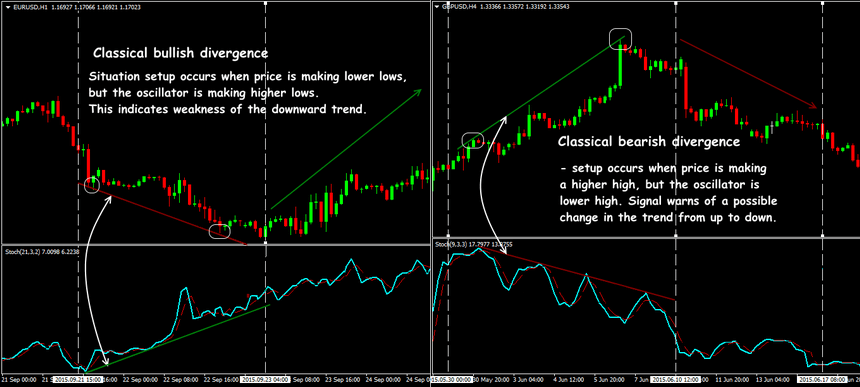

Divergence of stochastic lines and prices

A rare and very strong leading signal of a trend reversal. It is not recommended to use without analysis the intersections of averages and the state of critical zones.

- Buy a deal if the price has updated local Low, and the indicator line could not break its last min. At the time of divergence formation, the indicator value is in oversold zone. StopLoss - below last local min.

- We open deal for sale if the price has updated local High, and the indicator line could not break its last max. At the time of formation of divergence, the indicator value is in overbought zone. StopLoss is above last local max.

Crossing the balance line

The middle line divides the range of indicator into a zone of bulls (50-100) and a zone of bears (0-50). When price is at level 50, that is - the closing of candles occurs around the middle of range - the market is uncertain. If, after breakdown of line 50, Stochastic Oscillator indicator continues to move upwards - the bulls become stronger, if downward − bears are stronger. The price after a turn from a critical zone with a high degree of probability will reach, at least, to an average line. Situations when the lines, leaving one of the zones, return, not reaching the level of 50, are extremely rare.

How to use Stochastic Oscillator in Forex?

Stochastic shows the ability of prices to update their extremum. The indicator is actively used by short-term traders, since it takes into account not only closing prices (such as RSI), but max/min, which allows to correctly estimate how overbought/oversold the market is. On an uptrend Stochastic, only purchases are made, and in the bear market only sales).

If a Stochastic reversal occurs, then the leading player group loses its strength (especially if it is from overbought/oversold zones), and soon the reverse movement is more likely.

Stochastic Oscillator trading must take into account the direction and nature of behavior of stochastic lines. The depth of the indicator lines entering overbought/oversold zones shows how strong reverse momentum of movement can be.

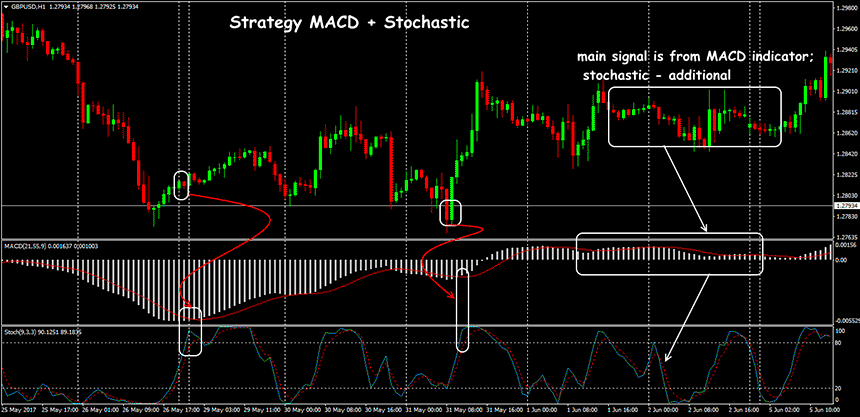

If during the counter-momentum period the Stochastics lines go synchronously, and fast one is slightly ahead of slow one − the signal is strong enough. If the impulse is accompanied by a constant intersection of Stochastic lines, then its further development is in question.

Several practical notes

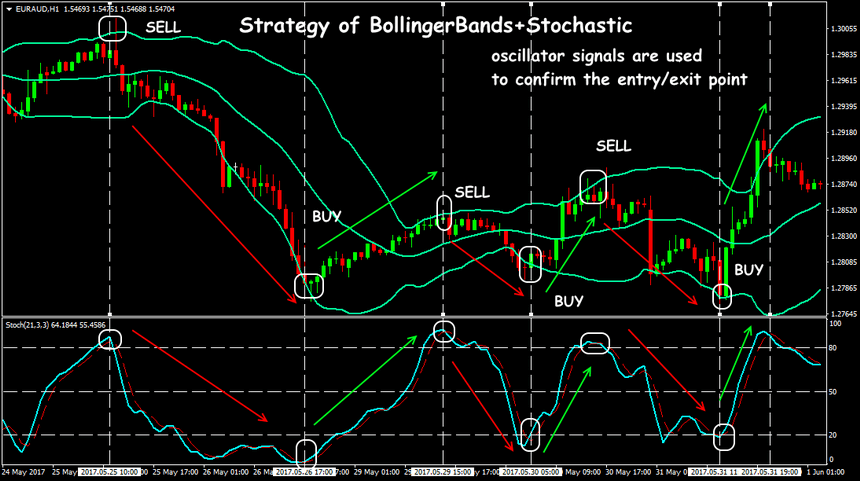

Stochastic Oscillator works well at the side of the price and needs a trend filter on the active traffic areas.

The output of Stochastic lines to critical zones does not mean appearance of a point for immediate entry - it is necessary to analyze the general trend. Long-term traders use it to determine the cycles, as weekly Stochastics show a balance of power in the market. At sharp price impulses indicator quickly leaves to extreme values, moreover - can move in a critical zone long enough. In this case, the loss of good entry points or, conversely, the appearance of a large number of «false signals» is possible.

A Stochastic can not be the only source for making trading decisions − his signals should always have additional confirmation. The optimal variant of trading a Stochastic Oscillator − is to use it during a flattening or moderate correction to determine the search for an entry point in the direction of the main trend.